Should you install solar panels in retirement or before you retire?

An ideal retirement is one without bills!

A solar installation will beat any savings account or annuity for returns. Prices now start from just £4950.

As a small portion of your retirement investments, solar would be a perfect addition in retirement.

One way to eliminate your electricity bills is to install solar panels and battery storage that have been designed around your home & usage.

Solar panels are a very illiquid investment – therefore you should not install them if they would take up a significant portion of your retirement savings.

However, as part of a well balanced retirement portfolio, solar panels and battery storage are a great addition to retirement. You’ll increase your self-sufficiency. Earn a tax-free return that potentially far exceeds alternatives, help the environment and potentially increase your homes Energy Performance Certificate to ‘A’ – adding 4% to your home’s value according to the Energy Savings Trust.

It depends.

There are several factors you should think about when considering installing solar panels in retirement.

We discuss these considerations below.

What are your goals for retirement?

1) Increase self-sufficiency/reduce monthly bills – so you can enjoy your retirement without thinking about your monthly outgoings or rising bills eating away at your retirement income. If this is one of your goals, installing solar panels is a good option to significantly reduce electricity bills.

2) Maintain a cash buffer – for emergencies or unexpected costs. If installing solar panels (£5000-£8500) would eat away at this buffer, due to solar panels being an illiquid investment, installing solar panels would not be a good option.

3) Ensure living costs are less than retirement income – Annuity rates in the UK are currently 3-5% depending on your age. It may be more beneficial to earn 9-11% per year from the savings on your electricity bill.

This will reduce your living costs more than the income an annuity of the same value would provide. Installing solar panels would be a good option – with the added benefit of protecting your retirement against energy price inflation.

Be sure to get a good quality, well designed solar panel system to ensure it’s a low-risk installation.

5) To move house? If you are planning to move home then it may be worth putting off a solar installation until you are in your new home.

4) Help the environment – If you would like to offset your impact on the environment, installing solar panels is probably the best thing you can do. We can tell you how many long haul flights it would offset per year, how many trees your install is equivalent to planting and much more.

You won’t have to change your behaviour, the solar panel installation will more than pay for itself over time and you’ll be doing more than most people to tackle climate change and pollution.

Annuity rates are very low

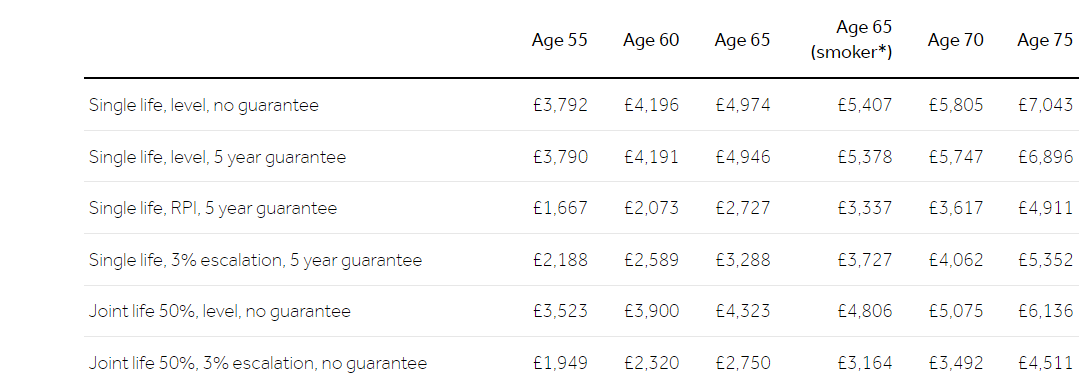

Below is a table showing the best annuity rates available today from Hargreaves Lansdown.

Let’s compare investing £100,000 into an annuity Vs £100,000 into an annuity and a solar installation.

As a solar installation protects against rising prices, and your partner can still benefit from the install after you have gone, we’ll use a Joint life 50% inflation-protected annuity in the comparison.

Annuity

£100,000 invested into Joint Life 50%, 3% escalation: Yearly income: £2750. Year 10 Income: £3695.

Annuity plus solar installation

£92,500 invested into Joint Life 50%, 3% escalation: Yearly income: £2530. Year 10 income: £3400

£7,500 solar and battery storage installation: Yearly savings: £700. Year 10 savings: £941

*Assumed energy price inflation 3%

Total: £3230 Year 10 Total: £4341

By adding a solar panel installation to your annuity you can increase the yield and protect against rising energy prices.

Make sure you get a high-quality, well-designed installation so the system performs as expected.

The difference between renting and owning your own energy supply

In 2021, we have had 2 large energy price increases. Two large price rises in just one year…

One in April 2021 of 9.2%

Another one was announced for October 2021, rising by 13%.

The average price per kWh from the ‘Big 5‘ plus Octopus is now 20.61p per kWh.

Adding £246 per year to energy bills.

By installing solar panels, you own your energy supply and can insulate yourself from rising electricity prices. Some of our customers are able to meet all of their day to day electricity needs from March until October.

Keep the grandchildren happy!

A slightly cheeky benefit to include in this article.

What has surprised me most since founding Leoht is the number of customers enquiring about solar energy because their children/grandchildren have been “gently nudging” them to do more for the environment.

Schools are very proactive in teaching children about minimising our impact on the environment, which is great to hear, so I felt like it was worth including.

Conclusion

There are lots of reasons why installing solar panels is a perfect complement to retirement (self-sufficiency, minimise outgoings during retirement, boost an annuity portfolio, environmental benefits).

There are also circumstances where installing solar panels in retirement wouldn’t be a good option. (Liquidity, moving house).

After deciding whether installing solar panels is right for you. Your next step should be to get a FREE design and quotation from Leoht.